Transfer Pricing Methodology – Conceptual Framework (II) incorporates transfer pricing changes in 2023 and 2024, IRB’s updates and Income Tax (Transfer Pricing) Rules 2023. The arm’s length range has been revised to be interquartile of 37.5 to 62.5, taking effect from YA 2023.

Transfer pricing is more an art than a science. It is subjective and contentious in nature. Transfer pricing methodology is the core essential in the preparation of transfer pricing documentations. The complete comprehension of the transfer pricing methodology is vital to select the most appropriate method to reflect the related parties’ transactions is carried out at arm’s length within an acceptable market range.

The comprehension of the transfer pricing methodology is enhanced with additional illustrations, working examples and real-life applications. New transfer pricing cases, in particularly Ensco Gerudi (CA) and Watsons (HC) decided in 2023 are included to appreciate the legal interpretation, application of s 140A and IRB’s power in transfer pricing audit.

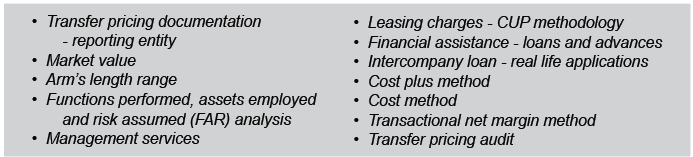

This book contains the following 12 chapters:

The law is stated as at 1 August 2024.

![[cover] TPM II](https://cdn.store-assets.com/s/772551/i/76912258.png?width=1024)