Transfer Pricing Methodology – Conceptual Framework sets out the working mechanism and applications of the five transfer pricing (TP) methods that are recommended by the OECD tax treaty model to ensure that transactions between related companies locally and abroad are carried out at 'arm's length'. These five methods are comparable uncontrolled price method, resale price method, cost plus method, profit split method, and transactional net margin method.

The conceptual framework of each method and its methodology are systematically laid out with illustrations and real life applications in explaining, supporting and justifying the business transactions with related companies fulfil the ‘arm’s length’ requirement. Contentious tax issues relating to transfer pricing are included with relevant computations provided to assist in understanding.

The in depth understanding of the TP methodology allows the formulation of TP policy, the drawing up of strategies on pricing decision, and the preparation of TP documentation to fully comply with various TP legislations under the Income Tax Act 1967, the related PU(A) orders and IRB guidelines. The most appropriate method selected would then able to accommodate the nature of the business transactions that are carried out between the related companies; support the basis of charging and ensure that the transactions are performed at arm's length within the allowable pricing range. Failure in compliance will result in additional tax being levied during a TP audit plus a penalty for incorrect return up to 100% of tax undercharged, together with a surcharge of up to 5%.

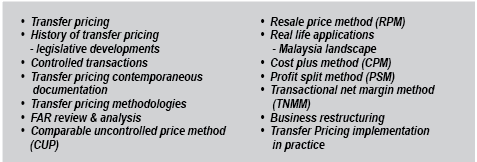

This reference has a total of 14 chapters on the following topics over approximate 276 pages:

The law is stated as at 1 March 2023.